Looking to improve their particular profitability, the majority of device companies in Western European countries are trying to find ways to tap into the advanced small appliances group, even those businesses which have never produced such services and products before. With air conditioning units mainly out-of-reach, due primarily to the predominance of Asian and Turkish players, producers have been forced to look elsewhere, especially when due to the fact air conditioning equipment volumes in 2013 reach simply two-thirds the degree of sales seen back 2008. Hot from the pumps for the phenomenal success of Nespresso, producers seem to have got all focused on the pod coffee business, with differing rates of success.

Looking to improve their particular profitability, the majority of device companies in Western European countries are trying to find ways to tap into the advanced small appliances group, even those businesses which have never produced such services and products before. With air conditioning units mainly out-of-reach, due primarily to the predominance of Asian and Turkish players, producers have been forced to look elsewhere, especially when due to the fact air conditioning equipment volumes in 2013 reach simply two-thirds the degree of sales seen back 2008. Hot from the pumps for the phenomenal success of Nespresso, producers seem to have got all focused on the pod coffee business, with differing rates of success.

Does investing in pod coffee machines nonetheless seem sensible for people which may have maybe not done this already? Certainly, the coffee machine category has skilled a growth in recent years, with worth product sales driven by alleged shut brewing systems such as Nespresso in Europe and K-Cup from Keurig in North America. But during united states large volumes and premiumisation tend to be set-to drive pod coffee machine price product sales up by 64per cent over 2013-2018, in west Europe the specific situation will be very various.

Right here, the unit volume of pod coffee devices will grow by a fairly moderate 7percent, and increased competitors is defined to operate a vehicle costs straight down, and therefore pod coffee maker value growth will slow quite a bit. Whenever we consider sales by specific items in Western Europe, while over 2008-2013 pod coffee machines were the solitary biggest worth driver, across next 5 years increased coffee machine penetration and harder competition will alter environmental surroundings, putting various other groups in limelight.

On the after that five years we anticipate cylinder vacuum cleaners to oust pod coffee machines in terms of recording the strongest absolute value growth. So, is-it still well worth buying coffee devices as a revenue booster? We see the coffee machine strategies for the top device players and analyse their particular blended success in light with this future situation.

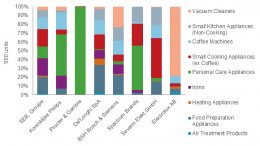

Product sales Breakdown of Selected Small Appliance Businesses, 2013

Supply: Euromonitor International

Best Performer

It absolutely was an earlier comprehension of the risks posed by Asian competitors and increased market saturation that led De’Longhi in the early 2000s to shift its focus from environment therapy and heating products to coffee devices and little appliances. This plan has actually certainly repaid as De’Longhi emerges today while the most useful doing little device player in west European countries. The business realized the best absolute amount development over 2008-2013, almost four times that recorded by Groupe SEB, the region’s leading tiny appliance organization by volume product sales. Within the same period, SEB recorded a rather warm 4percent gain, while Philips, Western Europe’s second-ranked little appliance company, saw its sales increase by 10%. 1 / 2 of De’Longhi’s worth escalation in Western Europe may be related to cooking devices, particularly blenders, while another 16per cent produced from coffee devices alone. These days, 20percent of most De’Longhi devices sold in the area tend to be coffee machines, rendering it Western Europe’s 3rd coffee maker manufacturer by units sold. Up to now, development in small appliances for the kitchen was adequate to counterbalance level sales of vacuums, atmosphere treatment and heating devices. However, it is time for De’Longhi to start out investing in flooring treatment devices to keep up its energy, because of the great performance expected from floor cleaners someday.

Top Eight Coffeemaker Manufacturers in West Europe, 2013

Resource: Euromonitor Global

The Market Leader

The slow growth recorded by SEB should not cover the incredible success your company has had using its coffee devices, which alone accounted for a staggering 55percent of the volume sales growth over 2008-2013. SEB can be the biggest difficult pod coffee machine maker in west Europe, having offered virtually 2.4 million products in 2013. This success can be related to its early alliance with Nestlé with regard to the production of Nespresso and also the Nescafé Dolce Gusto methods under its Krups brand. Nestlé’s brewing systems today take into account 51per cent of SEB’s coffeemaker product sales. None the less, losings in personal maintenance systems and fairly level development in irons and floor cleaners leave the business extremely reliant on coffee machine product sales.

The Video Game Changer

Philips has instead made a decision to exit the tough pod coffee category completely, terminating its partnership with Lavazza when it comes to creation of Lavazza A Modo Mio, that is now generated by Electrolux. Behind this lies a mixture of disappointing sales in addition to decision to focus exclusively on its soft pod Senseo machine, while purchasing advanced standard coffee machines. Specifically, the company will focus on added-value filter coffee devices and high-end espresso coffee manufacturers as a result of its purchase of Italian professional coffeemaker producer Saeco.

The Newcomers

Electrolux has actually decided to enter the hard pods group, replacing Philips inside relationship with Lavazza when it comes to production of A Modo Mio coffee devices. Will Electrolux do better than Philips? Just time will tell. Sales thus far haven't been exemplary but a significantly better shelf positioning as well as financial investment from Lavazza in more convincing marketing and advertising could allow the product to better compete keenly against Nespresso. Indeed, Electrolux is most likely among the best put organizations to fully capture value development in the vacuum cleaners group, currently having made great efforts to enhance advanced product sales. This is quite obvious at IFA, where, alongside Dyson and German players BSH and Miele Electrolux was without a doubt within forefront of vacuum cleaner development with a focus on both cylinder including rechargeable stick vacuum cleaners. Which is undoubtedly this type of innovation which driving consumers to pay more on floor treatment devices.

Troubled Italian white items producer Indesit has also established reduced small device range in 2013 so as to revive its main point here. Firstly, it launched its espresso pod machine, this time around as a system open to numerous coffee lovers. Which means consumers should be able to use different branded pods, with respect to the range coffee brewers prepared to companion Indesit – a model which resembles that United States coffeemaker monster Keurig. This is part of a long-term technique to achieve greater profitability by repositioning the complete business’s portfolio inside the mid-to-high-end range. Nonetheless, this alone will unlikely be sufficient to bring back the business’s bottom line inside mid-term. The advanced part has already been fairly crowded, without any indication of Nespresso losing its dominant position in coffee machine category.